This article was initially published in Polish, in Realny kapitalizm. Wokół teorii kapitału monopolistycznego[Real Capitalism: Exploring Monopoly Capital Theory], edited by Grzegorz Konat and Przemysław Wielgosz (Warsaw: Instytut Wydawniczy Książka i Prasa, 2017).

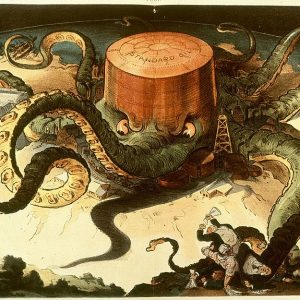

“Monopoly capital” is the term often used in Marxian political economy and by some non-Marxist analysts to designate the new form of capital, embodied in the modern giant corporation, that, beginning in the last quarter of the nineteenth century, displaced the small family firm as the dominant economic unit of the system, marking the end of the freely competitive stage of capitalism and the beginning of monopoly capitalism.

Marx’s

Capital, the first volume of which was published in 1867, was designed to uncover the laws of motion of the nineteenth-century era of free competition, and was based in part on the assumption that production was carried out by numerous individual capitals (or firms).

1 Each of these capitals accounted for a negligible portion of society’s total value added, and thus had little control over their own price and output levels, which were dictated by impersonal market forces. Yet, unlike the other classical economists, Marx recognized that such an environment of atomistic competition was a transitory historical phenomenon. “The battle of competition,” he wrote, “is fought by the cheapening of commodities. The cheapness of commodities depends,

ceteris paribus, on the productiveness of labor, and this again on the scale of production. Therefore, the larger capitals beat the smaller…. [C]ompetition rages in direct portion to the number and in inverse proportion to the magnitude of the rival capitals.” Hence, capital accumulation presupposed both a growth in the size of individual capitals (concentration, or accumulation proper) and the fusion together of many capitals into “a huge mass in a single hand” (centralization). Moreover, the credit system, which begins as a “humble assistant of accumulation,” soon “becomes a new and terrible weapon in the battle of competition, and is finally transformed into an enormous social mechanism for the centralization of capitals.”

2

As Engels observed decades later, the rise of the joint stock company or modern corporation heralded the fact that: “the old boasted freedom of competition has reached the end of its tether and must itself announce its obvious, scandalous bankruptcy.”

3 Thus, there can be no doubt that Marx and particularly Engels recognized that a historical turning point had been reached. Nevertheless, they saw the demise of free competition as marking not a new stage of capitalism, but as a harbinger of socialism to come. It was not until some years later, in the work of subsequent theorists, that studies of monopoly capitalism as a distinct phase in the evolution of the system arose.

The first major theorist of monopoly capitalism was Thorstein Veblen, a rebel economist of the North American left, deeply influenced by Marx, but not himself a Marxist. In

The Theory of Business Enterprise (1904) and

Absentee Ownership and Business Enterprise in Modern Times (1923), Veblen emphasized such characteristic themes of monopoly capital theory as the rise of corporate finance; the tendency for monopolistic profit margins to widen at the expense of less powerful firms and workers; the systematic promotion of excess capacity; and the interpenetration of sales and manufactures.

4 However, Veblen’s more powerful insights were largely ignored by his followers within institutionalist economics in the United States. Consequently, it was only in the Marxist tradition—where Veblen’s work was little known—that a continuing stream of work on monopoly capitalism emerged.

Here the landmark study was

Finance Capital (1910) by the Austrian Marxist Rudolf Hilferding, which attempted to integrate into the core of Marx’s theory such increasingly important phenomena as the developing market for industrial securities, the growing role of banks in the concentration and centralization of capital, and the system-wide consequences of expanding monopolization. Aside from the emphasis that he placed on bank capital in this whole development, Hilferding’s analysis is chiefly remembered for a conclusion reached in chapter 15: “The ultimate outcome of this process [of monopolization] would be the formation of a general cartel. The whole of capitalist reproduction would then be consciously regulated by a single body which would determine the volume of production in all branches of industry.”

5

In historical retrospect, it is clear that this picture was overdrawn. Powerful counter-tendencies such as the breakup of old firms and the founding of new ones made concentration and centralization a more uneven process than Hilferding expected. Moreover, Hilferding’s concern with this abstract notion of a “general cartel” kept him from developing a concrete theory that would explain the modifications in accumulation associated with a monopolistically competitive market, dominated by a handful of giant, “corespective” firms.

6

Hilferding’s analysis had pointed to the growth of capital export and of transnational rivalry between mammoth corporate trusts. Out of this arose Lenin’s

Imperialism, the Highest Stage of Capitalism, written in 1916, and his observation that, “If it were necessary to give the briefest possible definition of imperialism we should have to say that imperialism is the monopoly stage of capitalism.”

7 However, while basing his theory on the predominance of monopoly, neither Lenin nor any of his early followers in the 1920s and ’30s—with the exception of E. A. Preobrazhensky, whose work,

The Decline of Capitalism (1931) was suppressed in the U.S.S.R.—examined the implications of this for the underlying theory of accumulation.

8

Further progress in the formation of a theory of monopoly capitalism had to await the integration of the analysis of concentration and centralization, with the understanding of economic crisis that had evolved out of the famous debate over Marx’s reproduction schemes. As with mainstream theory—which in the 1930s had produced a theory of imperfect competition in the work of Joan Robinson and Edward Chamberlain, followed by a theory of crisis in John Maynard Keynes’s

General Theory that was still based on the assumption of free competition—these two strands of a complete theory of accumulation under modern capitalism were cut off from each other.

9 The first to unite them was the Polish Marxist economist Michał Kalecki—often credited with having discovered in the early 1930s all of the essentials of Keynes’s

General Theory before Keynes himself. In such later works as

Essays in the Theory of Economic Fluctuations and

Theory of Economic Dynamics, Kalecki fused the class-based analysis of realization crisis derived from Marx and Rosa Luxemburg, with what he called a rising “degree of monopoly” (related to Marx’s surplus value concept), developing a unified theory of accumulation under monopoly capitalism.

10 As Kalecki wrote: “Monopoly appears to be deeply rooted in the nature of the capitalist system: free competition, as an assumption, may be useful in the first stage of certain investigations, but as a description of the normal stage of capitalist economy it is merely a myth.”

11

This argument was carried forward by Josef Steindl, a young Austrian economist who was one of Kalecki’s colleagues at the Oxford Institute of Statistics during the Second World War. Steindl’s

Maturity and Stagnation in American Capitalism, first published in 1952, explored the causes of the Great Depression of the 1930s, contending that growing monopolization raised profit margins (or the rate of surplus value) in core industries.

12 This led to excess capacity as large firms protected their higher margins in the face of weaknesses in demand by reducing capacity utilization rather than prices. Excess capacity dampened the rate of growth of investment. Hence, stagnation, or slow growth and widening unemployment and underemployment and idle capacity, represented the general economic trend.

Monopoly Capital by Paul Baran and Paul Sweezy, published in 1966, originated with the dissatisfaction of these thinkers with their earlier major contributions in Sweezy’s

The Theory of Capitalist Development (1942) and Baran’s

The Political Economy of Growth (1957).

13 Sweezy was a former professor of economics at Harvard and editor of

Monthly Review, and Baran was a professor of economics at Stanford.

Monopoly Capital took the Kalecki-Steindl framework as its initial point of departure, seeking to draw out the wider societal implications. In this view, Marx’s law of the tendency of the rate of profit to fall, associated with the stage of free competition, had been replaced, in the monopoly capitalist stage, by a law of the tendency of the surplus to rise. The economic surplus was defined as the difference between total social output and the socially necessary labor costs of producing it. The surplus concept was employed as a complementary category to the classical concept of surplus value, facilitating the exploration of contradictions specific to monopoly capitalism such as the growing role of waste in production, which were not easily addressed using the surplus value category.

The argument of

Monopoly Capital focused on the critical problem of surplus absorption as the chief contradiction at this stage of accumulation. Surplus could be absorbed in one of three ways: (1) it could be consumed, (2) it could be invested, or (3) it could be wasted. Capitalist consumption accounted for a decreasing share of demand as income grew, while investment took the form of new productive capacity, which served to inhibit new net investment. Although there was always the possibility that altogether new “epoch-making innovations”—resembling the steam engine, the railroad, and the automobile in their overall scale and effect—could emerge, allowing the system to break free from the stagnation tendency, such massive, capital-absorbing innovations were by definition few and far between. Hence, the system of private accumulation, if left to itself, exhibited a powerful tendency toward stagnation. If periods of rapid growth nonetheless occurred—Baran and Sweezy were writing at the high point of the post-Second World War expansion—this was due to such countervailing factors to stagnation as the sales effort, military spending, and financial expansion (the last addressed at the end of their chapter on the sales effort). All such countervailing factors were, however, of a self-limiting character and could be expected to lead to bigger contradictions in the future.

A more comprehensive theory of monopoly capital, Baran and Sweezy noted, would have to consider the labor process, which had occupied such a central place in Marx’s analysis—something that they did not attempt in what they called their “essay-sketch.” Here Harry Braverman stepped in with his pathbreaking

Labor and Monopoly Capital (1974), making it clear that the degradation of work brought on by the division of labor, as Marx had described it in

Capital, was in many ways heightened under monopoly capitalism, with the rise of scientific management.

14 Other works in this general tradition in the 1960s and ’70s included Harry Magdoff’s

The Age of Imperialism, James O’Connor’s

The Fiscal Crisis of the State, and Stephen Hymer’s

The Multinational Corporation. The Union for Radical Political Economists, organized in 1968, brought out its first economic crisis reader in 1975, entitled

Radical Perspectives on the Economic Crisis of Monopoly Capital.

15

The concept of monopoly capital also had an enormous influence in the global South. Che Guevara, who met with both Sweezy and Magdoff, and who identified closely with Baran’s argument on monopoly capital and economic surplus in

The Political Economy of Growth, declared in 1965: “Ever since monopoly capital took over the world, it has kept the greater part of humanity in poverty, dividing all of the profits among the group of most powerful countries.”

16

Although the notion of the monopoly stage of capitalism played a key role in the work of most Marxian economists up until the 1970s—e.g., Maurice Dobb in

Studies in the Development of Capitalism (1947), Ernest Mandel in

Marxist Economic Theory (1962), and Samir Amin in

Accumulation on a World Scale (1970)—by the late 1970s the notion of monopoly capital had begun to wane.

17 During what became known as the “back to Marx” movement, or the growth of fundamentalist Marxian political economy, it became increasingly common to assume the ascendancy of free competition throughout the history of capitalism, and to reject the notion of historical stages of capitalist development altogether. Along with this came the abandonment (or at least the downplaying) of notions of concentration and centralization of production and monopoly profits. Economist John Weeks wrote in his

Capital and Exploitation in 1981 that “the monopolies that stalk the pages of the writings of Baran and Sweezy have no existence beyond the work of those authors.”

18 Numerous critics of monopoly capital theory claimed that the internationalization of capital—by breaking down U.S. hegemony and making the advanced capitalist countries as a whole more vulnerable to foreign trade and capital movements—had demolished the structure of monopolistic accumulation.

19

In contrast, a number of radical and Marxian theorists—including Keith Cowling in

Monopoly Capitalism (1982) and John Bellamy Foster in

The Theory of Monopoly Capitalism (1986) and (with Robert W. McChesney)

The Endless Crisis (2012)—argued with increasing force that the reality was one of continuing concentration and centralization of capital on a world scale, or the internationalization of monopoly capital, with fewer and fewer firms controlling larger parts of both national and international economies.

20 This was coupled with the institution of a system of “divide and rule” in relation to global labor. In an influential empirical study (carried out with the help of R. Jamil Jonna), Foster and McChesney demonstrated that at the time of the Great Financial Crisis of 2007–09, the top 200 corporations in the United States accounted for about 30 percent of gross profits in the economy (up from about 13 percent in 1950), while at the world level the top 500 global corporations received about 40 percent of total global revenue (up from around 20 percent in 1960).

21

Nevertheless, the main focus of monopoly capital theorists from the 1980s on was directed not so much at debates about the status of monopoly capital, but at explaining the onset of economic stagnation, beginning in the mid-1970s, and how financialization emerged as a countervailing factor, thereby lifting the economy. Key works in this regard were Magdoff and Sweezy’s

Stagnation and the Financial Explosion in 1987, followed by

The Irreversible Crisis in 1988.

22 In 1997, Sweezy argued that monopolization and stagnation had led to the emergence of a new layer of contradictions in the system, which he summed up as “the financialization of the capital accumulation process.”

23

Beginning around 2000, theorists in the monopoly capital tradition therefore began to develop the notion of a new phase of monopoly capitalism, or monopoly-finance capital, in which monopolization, stagnation, and financialization operated as simultaneous and mutually reinforcing trends. Foster and Fred Magdoff explored this thesis in

The Great Financial Crisis, published in 2009, shortly after the housing bubble burst. In

The Endless Crisis in 2012, Foster and McChesney were among the first to argue that with the weakening of financialization as a result of the crisis of 2007–09, secular stagnation was likely to persist for the indefinite future. Meanwhile, Amin, writing in

The Law of Worldwide Value in 2011, declared we are living in “the late capitalism of generalized, financialized, and globalized oligopolies.”

24 The result of these developments has been a growing interest in the theory of monopoly capital and the insights it provides into the structural crisis of capital in our time. This renewed interest was reflected in the publication in 2016 of a

special issue of Monthly Review on “Monopoly Capital a Half-Century On,” with a host of major economic thinkers, including Amin, Kent Klitgaard, Costas Lapavitsas, Michael Meeropol, Ivan Mendieta-Muñoz, Prabhat Patnaik, Jan Toporowski, Mary V. Wrenn, and others.

Concluding an analysis in 2016, Patnaik observed: “Unless some new ‘bubble’ arises, of which there are no signs, and which too would inevitably collapse, precipitating a new crisis, the world economy will continue to be mired in stagnation. The basic framework of

Monopoly Capital helps us to understand this predicament better than any other book written since.”

26

Notes

- ↩Karl Marx, Capital, vol. 1 (London: Penguin, 1976).

- ↩Marx, Capital, vol. 1, 776-80.

- ↩Marx, Capital, vol. 3 (London: Penguin, 1981), 568-69.

- ↩Thorstein Veblen, The Theory of Business Enterprise (New York: Scribner, 1904), Absentee Ownership and Business Enterprise in Modern Times (New York: Huebsch, 1923).

- ↩Rudolf Hilferding, Finance Capital (London: Routledge and Kegan Paul, 1981), 234.

- ↩Joseph A. Schumpeter, Capitalism, Socialism, and Democracy (New York: Harper, 1942), 90.

- ↩V. I. Lenin, Imperialism, the Highest Stage of Capitalism (New York: International Publishers, 1939), 88.

- ↩E. A. Preobrazhensky, The Decline of Capitalism (Armonk, NY: M. E. Sharpe), 1985.

- ↩Joan Robinson, The Economics of Imperfect Competition (London: Macmillan, 1933), E. H. Chamberlain, The Theory of Monopolistic Competition (Cambridge, MA: Harvard University Press, 1933).

- ↩Michał Kalecki, Essays in the Theory of Economic Fluctuations (New York: Russell and Russell, 1939), Theory of Economic Dynamics (London: George Allen and Unwin, 1954).

- ↩Michał Kalecki, Collected Works, vol. 1 (Oxford: Oxford University Press, 1990), 252.

- ↩Josef Steindl, Maturity and Stagnation in American Capitalism (New York: Monthly Review Press, 1976).

- ↩Paul M. Sweezy, The Theory of Capitalist Development (New York: Oxford University Press, 1942; Paul A. Baran, The Political Economy of Growth(New York: Monthly Review Press, 1957); Paul A. Baran and Paul M. Sweezy, Monopoly Capital (New York: Monthly Review Press, 1966).

- ↩Harry Braverman, Labor and Monopoly Capital (New York: Monthly Review Press, 1974).

- ↩Harry Magdoff, The Age of Imperialism (New York: Monthly Review Press, 1969); James O’Connor, The Fiscal Crisis of the State (New York: St. Martin’s Press, 1973); and Stephen Hymer, The Multinational Corporation (Cambridge: Cambridge University Press, 1979); Union for Radical Political Economists, Radical Perspectives on the Economic Crisis of Monopoly Capital (New York: URPE, 1975).

- ↩Che Guevara, Speech at the Afro-Asian Conference in Algeria, February 24, 1965, available at http://marxists.org.

- ↩Maurice Dobb, Studies in the Development of Capitalism (New York: International Publishers, 1947, 1963); Ernest Mandel, Marxist Economic Theory (New York: Monthly Review Press, 1968); Samir Amin, Accumulation on a World Scale (New York: Monthly Review Press, 1974).

- ↩John Weeks, Capital and Exploitation (Princeton: Princeton University Press, 1981), 165.

- ↩On the notion, especially prevalent in the late 1980s and 1990s, that international competition had effectively eliminated monopoly capital, see Robert Brenner, The Economics of Global Turbulence(London: Verso, 2006), 54, and Robert J. S. Ross and Kent C. Trachte, Global Capitalism (Albany: State University of New York Press, 1990), 38–50.

- ↩Keith Cowling, Monopoly Capitalism (New York: John Wiley and Sons, 1982); Keith Cowling and Roger Sugden, Transnational Monopoly Capitalism (New York: St. Martin’s, 1987); John Bellamy Foster, The Theory of Monopoly Capitalism (New York: Monthly Review Press, 1986, 2014); John Bellamy Foster and Robert W. McChesney, The Endless Crisis (New York: Monthly Review Press, 2012).

- ↩John Bellamy Foster, Robert W. McChesney, and R. Jamil Jonna, “Monopoly and Competition in the Twenty-First Century,” Monthly Review 62, no. 11 (April 2011): 1–9. This article was incorporated into Foster and McChesney’s The Endless Crisis.

- ↩Harry Magdoff and Paul M. Sweezy, Stagnation and the Financial Explosion(New York: Monthly Review Press, 1987), The Irreversible Crisis (New York: Monthly Review Press, 1988).

- ↩Paul M. Sweezy, “More (or Less) on Globalization,” Monthly Review 49, no. 4 (September 1997): 1–4.

- ↩Samir Amin, The Law of Worldwide Value (New York: Monthly Review Press, 2010), 118.

- ↩Paul A. Baran and Paul M. Sweezy, “Some Theoretical Implications,” Monthly Review 64, no. 3 (July–August 2012): 24–59, “The Quality of Monopoly Capitalist Society: Culture and Communications,” Monthly Review 65, no. 3 (July–August 2013): 43–64, The Age of Monopoly Capital: Selected Correspondence of Paul A. Baran and Paul M. Sweezy, 1949–1969, Nicholas Baran and John Bellamy Foster, eds. (New York: Monthly Review Press, 2017); Jan Toporowski, Michał Kalecki, An Intellectual Biography, Vol. 1, Rendezvous in Cambridge, 1899–1939 (London: Palgrave Macmillan, 2013).

- ↩Prabhat Patnaik, “Monopoly Capital Then and Now,” Monthly Review 68, no. 3 (July–August 2016): 38.